Policy Position - 5G, Militarisation, and the Case for a Space Resource Rent Tax

- gattygee

- Jul 7

- 15 min read

The 5G rollout is not just about faster downloads and smart fridges. Behind the buzzword lies a silent arms race, where telecommunications infrastructure doubles as military positioning. As the line blurs between civilian tech and defence assets, it’s time to ask a bigger question: who profits from the skies, and what do they pay for it?

5G: Infrastructure or Infrastructure for Control?

5G networks promise lightning-fast speed and ultra-low latency — a game-changer for hospitals, transport, and energy systems. But they're also crucial to:

Autonomous weapons systems

Battlefield communications

Space-based surveillance

Secure command-and-control operations

Private 5G networks are now being deployed on military bases across the US, Australia, and allied nations. These networks serve dual purposes: enhancing warfighting capability and enabling joint interoperability. In effect, 5G becomes a layer of military infrastructure, controlled not solely by public institutions but in collaboration with, or in service of, private defence contractors and telcos.

Orbit Is Not Free Real Estate

While ground-based towers grab public attention, the real game is being played in low Earth orbit (LEO). The satellites powering secure communications, surveillance, and global connectivity are being launched at an exponential rate. SpaceX alone has over 6,000 Starlink satellites in orbit. Amazon’s Project Kuiper is coming. Defence contractors are getting in on it, too — and not just for communications. Think surveillance, targeting, and resource extraction.

But here's the problem: There is no meaningful taxation on the private exploitation of orbital space. Launch providers, satellite operators, and data resellers can monetise public space without paying rent.

Why We Need a Space Resource Rent Tax (SRRT)

Just as we once taxed mining companies for extracting finite public resources like coal and gas, it’s time to recognise orbital real estate and space-based bandwidth as finite public commons.

A Space Resource Rent Tax would:

Ensure fair economic return from commercial exploitation of orbital slots, frequencies, and space-based surveillance.

Help regulate the rapidly militarising domain of space, where billionaires and military-industrial partnerships act with impunity

What Can Be Done?

Push for a Parliamentary Inquiry into private 5G networks, militarisation, and space asset ownership.

Introduce legislation that mandates public benefit returns from all commercial use of space-based infrastructure.

Back a Space Resource Rent Tax, starting with satellite operators, spectrum auction winners, and defence-linked space ventures.

As Australia aligns itself with US-led digital warfare strategies, we must not sleepwalk into a future where our skies are privatised, our communications militarised, and our public wealth extracted.

If 5G is the operating system of the future, then space is the hardware. It’s time we made the corporations who profit from both pay rent

How Privatisation Drives Up the Cost of Living: The Case of the National Transmission Agency

The push for 5G and space-based infrastructure is unfolding against a broader backdrop: the steady privatisation of public assets, sold off under the guise of efficiency — but often with devastating long-term consequences for affordability and sovereignty.

A key example is the National Transmission Agency (NTA), once responsible for delivering broadcast and emergency communication services across the country. When the NTA was privatised, it was eventually absorbed by Broadcast Australia (now BAI Communications), a private corporation. The outcome?

Reduced public control over essential communications infrastructure

Higher costs to the ABC and SBS to access their own transmission networks

Outsourced accountability — decisions driven by shareholder profit, not public good

Vulnerability to foreign ownership, given Australia's weak controls over strategic infrastructure sales

Now, with 5G and space-based internet, we’re watching the same pattern repeat: infrastructure that should be treated as a national utility — akin to water or electricity — is instead being handed to private telcos, defence contractors, or tech giants with zero obligation to serve the public interest.

When essential infrastructure is privatised:

Costs get passed on to households, either directly through user fees or indirectly through cuts to services

Rural and regional communities lose out, as market logic doesn’t favour low-profit areas

The government loses policy control, making national security and social equity harder to uphold

Why It All Connects: From the NTA to the Stars

Whether it's a broadcast tower in regional Tasmania or a satellite orbiting over the Pacific, these are public goods being enclosed for private profit.

That’s why a Space Resource Rent Tax is not just about orbital fairness — it’s about drawing a line in the sand. It’s about saying:

“If you profit from public space — or public infrastructure — you owe a debt to the people.”

We’ve seen what happens when we sell the farm. Let’s not sell the sky.

The National Transmission Agency (NTA) was an agency within the Australian Department of Communications and the Arts that existed from its inception in 1992 until 1997. Its main function was to administer the transmissions of the Australian government's network of broadcasting stations.

The NTA was established in July 1992 by the Australian government to supervise the operation of the National Transmission Network (NTN). The NTN was, and still is, the network of radio and television transmitters that broadcast the programs of Australia's national broadcasters, namely SBS and ABC. The NTA existed as a separate cost centre within the Department of Communications and the Arts because it was funded directly from the Department of Finance during its years of operation.

Its function was to oversee various Australian government programs relating to the broadcasting of ABC and SBS television and radio programs within Australia and of ABC Radio Australia on shortwave internationally. This was done primarily through administering maintenance and equipment supply contracts. The NTA's funding agreement with the Department of Finance required it to meet savings and performance targets. It had to do this while maintaining the integrity and reliability of the transmission facilities themselves. During the life of the NTA, it moved from exclusive reliance on Broadcast Communications and Telstra towards a process of competitive tendering to provide its broadcasting services. A significant source of extra funding to the NTA was "site-sharing" of transmission facilities with commercial broadcasters, telecommunications companies and emergency service communication networks. This site-sharing meant that NTA facilities were made available in return for payment.

The operational efficiency of the NTA was reviewed in 1995 and again in 1996 following a change of government in Australia. The Howard government chose to privatise the NTA in 1997. Macquarie Bank completed its acquisition of NTA in 2002 and re-branded it as Broadcast Australia.

In November 2019, Broadcast Australia rebranded as BAI Communications Australia, marking a strategic shift from a national broadcast transmission provider to a global communications infrastructure company. This rebranding reflects BAI's expansion into international markets, including operations in Canada, the UK, the USA, and Hong Kong, and its evolution to offer a broader range of services beyond traditional broadcasting.

BAI Communications now positions itself as a shared infrastructure specialist, delivering wireless solutions across various sectors such as broadcasting, government, transport, and private enterprises. In Australia, BAI operates one of the world's most extensive transmission networks, providing fully managed television and radio services that cover 99% of the population.

The company's transformation underscores a broader trend of privatising essential public infrastructure. While BAI continues to serve major broadcasters like ABC and SBS, its shift towards private ownership and global operations raises questions about public accountability and the implications for national sovereignty over critical communication services.

As BAI Communications continues to expand its footprint in the telecommunications landscape, its evolution from a national agency to a private entity exemplifies the complexities and debates surrounding the privatisation of public assets and the future of national infrastructure management.

BAI Communications is a privately held company. It is majority-owned by the Canada Pension Plan Investment Board (CPPIB), which holds an 86% stake. Other investors include Alberta Investment Management Corporation (AIMCo) and Kindle Capital.

Originally established as the National Transmission Agency, BAI Communications was acquired by Macquarie Bank in 2002 and rebranded as Broadcast Australia. In 2009, CPPIB acquired the company, and it was later rebranded as BAI Communications in 2019.

As a private entity, BAI Communications operates independently of public ownership, allowing it to make strategic decisions without the obligations of a publicly listed company. This structure has enabled BAI to expand its operations globally, including providing wireless services in the Toronto subway system and mobile coverage solutions on the London Underground.

In May 2022, Mobilitie, a leading U.S. wireless infrastructure provider and subsidiary of Australia's BAI Communications, announced the acquisition of Signal Point Systems, a telecommunications infrastructure company specializing in services for U.S. military bases.

Strategic Expansion into Military Connectivity

This acquisition aims to enhance 5G and broadband connectivity for military personnel and their families across the United States. By integrating Signal Point's expertise in developing infrastructure on Department of Defense properties with Mobilitie's comprehensive wireless solutions, the combined entity seeks to accelerate the deployment of advanced communication services on military installations.

Mobilitie's offerings include multi-carrier 5G connectivity, communications towers, Distributed Antenna Systems (DAS), small cells, Wi-Fi, fiber connectivity, edge computing, and private networks utilizing both licensed and unlicensed spectrum. The acquisition of Signal Point, known for its focus on towers, small cells, fiber, and in-building solutions on military installations, complements Mobilitie's portfolio and expands its reach within the defense sector.

Christos Karmis, CEO of Mobilitie, emphasized that combining the two companies will allow for the acceleration of 5G and fiber-based broadband connectivity to U.S. military personnel nationwide. Phil Carrow, CEO of Signal Point, expressed enthusiasm about joining forces with Mobilitie to deliver next-generation wireless connectivity solutions.

Lieutenant General Michael Ferriter (Ret.), Senior Military Advisor to Signal Point, highlighted that the acquisition will exceed the expectations of the U.S. military and lay the foundation for the "smart" military bases of the future.

This strategic move reflects a growing trend of private sector involvement in enhancing military infrastructure, particularly in the realm of advanced communications. By leveraging private investment and expertise, the Department of Defense aims to modernize its facilities and provide improved services to military communities.

As 5G technology becomes increasingly integral to both civilian and military applications, partnerships between public institutions and private companies like Mobilitie and Signal Point are poised to play a crucial role in shaping the future of defense communications.

In June 2023, BAI Communications announced the rebranding of its Northern Hemisphere operations to Boldyn Networks, marking a significant transformation in its global strategy. This rebrand unifies several of BAI's international subsidiaries—including Mobilitie, Signal Point Systems, Transit Wireless, Vilicom, ZenFi Networks, and BAI Communications operations in the UK, Italy, and Hong Kong—under the Boldyn Networks banner.

The rebranding signifies a strategic shift, with Boldyn Networks establishing its global headquarters in the United Kingdom. This move reflects the company's focus on expanding its presence in the Northern Hemisphere, particularly in Europe and North America.

Boldyn Networks aims to be a leading provider of shared network infrastructure, supporting mobile and fixed network operators across various sectors, including transit, venues, government, military, and enterprise. The consolidation under a single brand is intended to streamline operations and enhance the company's ability to deliver integrated solutions.

It's important to note that BAI Communications Australia is not part of this rebranding initiative and will continue to operate under its existing name. While Boldyn Networks and BAI Communications Australia are now separate entities, they remain closely aligned through their common majority shareholder, the Canada Pension Plan Investment Board (CPP Investments).

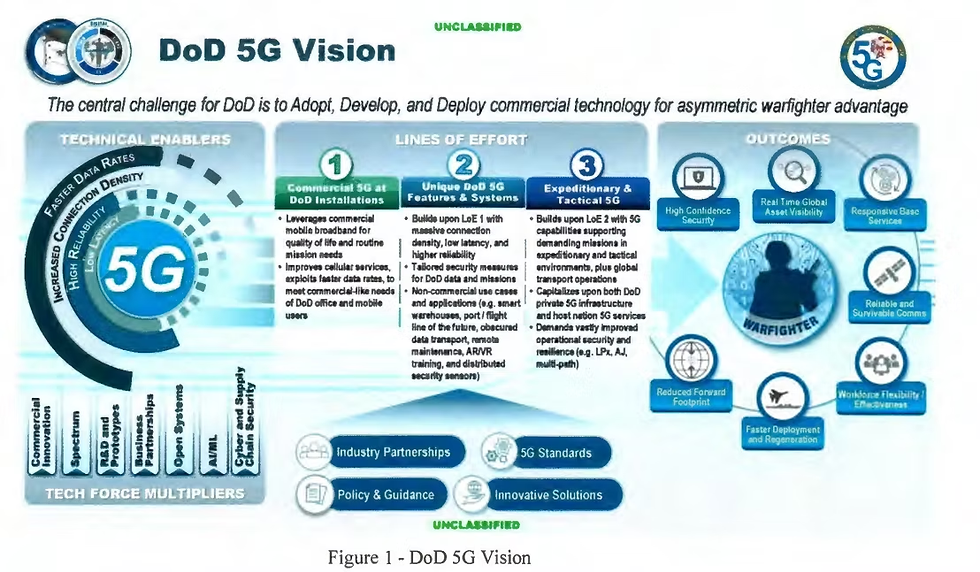

In November 2024, the U.S. Department of Defense (DoD) unveiled a comprehensive strategy to deploy private 5G networks across military installations, aiming to enhance operational capabilities, security, and connectivity for warfighters.

The blog post “Integrated Positioning and Communication via LEO Satellites: Opportunities and Challenges” explores how Low Earth Orbit (LEO) satellite systems are poised to revolutionize both communication and positioning technologies by integrating the two functions within a single infrastructure. Unlike traditional geostationary satellites, LEO satellites orbit much closer to Earth, allowing them to provide lower-latency communications and improved signal quality. This proximity also enables more precise real-time location tracking, making LEO systems ideal for applications like autonomous transport, emergency services, and next-generation mobile networks.

LEO satellites, orbiting between 160 and 2,000 kilometers above Earth, offer low-latency communication and high-resolution imaging capabilities due to their proximity to the planet. These attributes make LEO satellites ideal for real-time surveillance, reconnaissance, and rapid data transmission. The U.S. Department of Defense has been investing in LEO satellite constellations to bolster its communication networks and enhance situational awareness on the battlefield.

The public cloud infrastructure market in the western world already exceeds $100 billion, yet it has less than 15% market penetration. Over the next two decades, as it increasingly captures IT infrastructure spending, it could expand 10 to 20 times, reaching a $1 to $2 trillion market. If the current business model persists, it will also generate $1 to $2 trillion in managed and professional cloud infrastructure services. Considering typical EBITDA margins and EV/EBITDA multiples, this could result in a mid-trillion-dollar valuation for an industry currently led by three major players, with an additional $1 to $3 trillion in value for those offering managed and professional services in the cloud sector.

BAI Communications has successfully obtained licensed spectrum in the 3.8 GHz band from the Australian Communications and Media Authority (ACMA). This acquisition enhances our current mmWave spectrum assets and bolsters our capacity to provide advanced telecommunications solutions. With up to 50MHz of spectrum secured in major metropolitan and regional areas throughout Australia, this achievement enables us to expedite the rollout of private mobile network solutions.

The 3.8 GHz band spectrum is assigned through an area-wide apparatus license, with each license encompassing a 1.8 x 1.8 km cell within a national grid. We have strategically secured bandwidth in regions with high demand, where sectors like ports, logistics, manufacturing, and healthcare can significantly benefit from private connectivity solutions.

In November 2024, the Australian Communications and Media Authority (ACMA) initiated a consultation to remake three key radiocommunications instruments governing communications with space objects, which were set to sunset in 2025.

Radiocommunications (Australian Space Objects) Determination 2014

Radiocommunications (Foreign Space Objects) Determination 2014

Radiocommunications (Communication with Space Object) Class Licence 2015

The ACMA proposed remaking these instruments with minor wording and structural changes to clarify their intended effect, ensuring they continue to function effectively within Australia's regulatory framework. Notably, the draft Foreign Space Objects Determination included three additional entities:

NSLComm Ltd (Israel)

Plan-S Satellite and Space Technologies Inc. (Türkiye)

Rivada Space Networks GmbH (Germany)

These entities sought to apply for space and space receive apparatus licences to access frequencies mentioned in the draft Communication with Space Object Class Licence for communication with earth stations in Australia.

The Southern Guardian is a strategic initiative aimed at enhancing Australia's Space Domain Awareness (SDA) capabilities. This project is a collaborative effort between HENSOLDT Australia, the University of Tasmania, and the Tasmanian Government, collectively known as TEAM Tasmania.

In July 2021, HENSOLDT Australia, the Tasmanian Government, and the University of Tasmania signed a memorandum of understanding (MoU) to establish a sovereign Space Domain Awareness (SDA) system in Tasmania. This collaboration, known as "TEAM Tasmania," aims to position the state as a central hub for space surveillance and tracking in Australia.

Central to this initiative is the development of the Southern Guardian system, designed to monitor and track objects in Earth's orbit, including satellites and space debris. HENSOLDT Australia's Hobart office serves as the integration and data analysis center for this system, supporting both defense and commercial space operations.

Space Domain Awareness (SDA) has historically been the domain of governments—particularly the military—with the United States Space Command maintaining the most widely used catalogue of orbital objects. But the systems and methods developed during an era of around 100 satellite launches per year are now struggling to keep pace with a tenfold increase in activity. The growing accessibility and affordability of space launches have created an urgent need for next-generation SDA sensors and data analysis capabilities.

Enter Southern Guardian—a collaborative initiative between the University of Tasmania, HENSOLDT Australia, and the Tasmanian Government. This partnership combines the University’s continent-scale network of sensitive antennas, HENSOLDT’s advanced radar and information management systems, and Tasmania’s unique southern geographic advantage. Together, they are building a sovereign SDA capability designed to meet the demands of a crowded and increasingly contested orbital environment—serving both civilian and defence purposes.

Margot Ellis started a new position as a Space Governance Research Officer at UNSW Canberra, working with Duncan Blake on space law projects.

She was also a board member, including four years as a Director with Crime Stoppers Tasmania.

Gilmour Space Technologies, has attracted investment from several prominent sources, including Queensland Investment Corporation (QIC). They are custodians of their clients' capital, and manage a global portfolio of liquid and alternative assets. Headquartered in Brisbane, Australia, they have more than $100 billion in assets under management and offices in Sydney, Melbourne, New York, San Francisco, London, and Singapore. They partner with approximately 115 clients spanning Australia, the US, UK, Europe, Asia and the Middle East. Read their 2023/2024 annual report

Their real estate portfolio is $13.6 billion and draws our attention to investment partnerships with Government.

The Tasmanian Government has prepared the Tasmanian Development Amendment Bill 2024 to allow co-investment in strategic projects. The current elected members are pushing ahead with laws to allow developers to seek building approvals outside of councils, this new legislation is being developed to allow certain types of development applications to be determined by "independent" Development Assessment Panels (DAP).

Should our questions be, what type of "partnerships" are our elected officials involved in?

Are these partnerships beneficial for Tasmanians or do they benefit foreign investment portfolios? Do the new development amendments establish a fast-tracking pathway for the American Military Complex?

Margot Ellis’s decision to sell her shares in Vanguard Investments just prior to taking a role in Australia’s growing space sector raises serious concerns about conflict of interest and ethical transparency. Vanguard, one of the world’s largest institutional investors, holds significant positions in global defense and aerospace companies that stand to benefit from public policy decisions—particularly in areas like space infrastructure, surveillance technologies, and militarisation.

Return the National Transmission Agency to the Australian People

As a candidate for Braddon, I am calling for the restoration of public ownership of Australia's national transmission infrastructure.

For too long, vital broadcasting and communication infrastructure—once owned and operated in the public interest—has been sold off, corporatised, or handed to private operators who prioritise profit over access. This includes key assets once managed by the National Transmission Agency (NTA), which was dismantled in the late 1990s.

It’s time to reverse that mistake.

Policy Commitments:

Re-establish a National Transmission Agency (or similar public body) to oversee, maintain, and expand critical broadcast and communications infrastructure across Australia.

Guarantee universal, affordable access to radio, TV, and emergency communication services—particularly in remote and regional areas like the West Coast, Circular Head, and King Island.

Ensure sovereign control of our transmission networks so that no foreign company or private monopoly can interfere with national emergency broadcasting or public information access.

Rebuild technical capacity and public sector jobs in communications engineering and maintenance—revitalising a skilled workforce for the digital age.

Australia’s airwaves and signal towers were built by and for the public. It’s time we brought them home.

Space Resource Rent Tax (SRRT)

Policy Objective:Ensure that corporations profiting from Tasmanian-based space infrastructure or orbital exploitation contribute fairly to the public good.

Policy Details:

Introduce a Space Resource Rent Tax applied to private entities profiting from space operations or terrestrial infrastructure that supports orbital industries (e.g., ground stations, launch facilities, and satellite data hubs).

The SRRT would be calculated based on economic rent—the excess profits made after accounting for normal business returns—ensuring that public

infrastructure and natural advantage are not exploited without a public return.

Revenues will be invested into public science education, climate resilience infrastructure, and regional telecommunications upgrades.

Tasmania must not become a corporate space tax haven—particularly for foreign-owned firms using our geography without reinvesting in our communities.

Surveillance and Data Sovereignty Tax

Policy Objective:Ensure transparency, accountability, and public compensation when private or foreign entities operate surveillance or data-collection infrastructure in Tasmania.

Policy Details:

Implement a Surveillance Tax on private satellite operators, ISR contractors, and foreign military-linked tech entities that operate tracking, listening, or surveillance infrastructure from Tasmanian territory.

Require full disclosure of surveillance capabilities, data destinations, and third-party access.

Funds collected will support civil liberties advocacy, independent oversight, and public interest technology development.

Establish local consent and transparency standards before infrastructure is installed—residents and councils must not be left in the dark about who is watching or extracting data.

Critical Minerals Rent Tax (CMRT)

Policy Objective:

Capture windfall profits from Tasmania’s critical minerals and rare earths for reinvestment in local communities and sustainable industries.

Policy Details:

Introduce a Critical Minerals Rent Tax on corporations extracting lithium, rare earths, cobalt, and other strategic minerals from Tasmanian lands.

Revenue-sharing models will ensure funds return directly to mining-impacted communities for housing, healthcare, and environment remediation.

Mandate transparent value chain tracking from mine to export to prevent corporate transfer pricing, tax minimisation, and export laundering.

Real-Time Disclosure of Lobbying and Parliamentary Influence

Policy Objective:

Break the cycle of hidden influence by making lobbying and policy influence transparent in real time.

Policy Details:

Introduce Real-Time Lobbying Disclosure Laws requiring all ministerial meetings, lobbying efforts, and consultancy engagements to be logged and published within 24 hours.

Mandate watermarking of draft legislation and amendments to show origin of changes when influenced by third parties (e.g., lobbyists, consultants, foreign contractors).

Implement an open-access Parliamentary Influence Tracker to trace financial, political, and social lobbying patterns across departments and electorates.

Tech for Conservation: Strategic Partnership to Protect Tasmanian Devils & Wedge-Tailed Eagles

Tasmania’s natural heritage is under siege—from land clearing, industrial development, and climate impacts. Our Tasmanian Devils and Wedge-Tailed Eagles are now at extreme risk, not from ignorance, but from delay. We need urgent, real-time, science-driven action.

That’s why I am calling for the Tasmanian Government to forge an immediate strategic partnership with:

Virtual Tas (for spatial digital twin and geospatial tracking),

Agronomeye (for landscape-scale, digital agriculture and biodiversity intelligence),

Enzen Australia (for energy-environment integration and systems innovation).

These platforms are already being used across Australia to model water systems, monitor carbon baselines, and assess ecosystem health in real time. Let’s use them for Tasmanian species before it’s too late.

Policy Commitments

1. Establish a Real-Time Biodiversity Risk Map

Leverage Virtual Tas’s digital twin capabilities to create dynamic, publicly accessible maps showing where endangered species are most at risk from forestry, roads, energy corridors, and development.

Integrate local ecological knowledge, satellite data, and species telemetry to ensure no habitat is sacrificed due to outdated planning systems.

2. Deploy Agronomeye for Landscape Conservation Intelligence

Use Agronomeye’s AgTwin™ platform to model habitat connectivity, carbon sequestration potential, and landscape degradation in areas overlapping with Tasmanian Devil and Eagle populations.

Integrate this with agricultural planning to support regenerative farming practices that co-exist with protected species.

3. Mandate Environmental Impact Watermarking in Energy Projects

Through a partnership with Enzen, apply systems modelling to infrastructure and energy projects, showing in real time the projected impacts on biodiversity and recommending mitigation pathways.

This would help ensure that eagle nesting areas and devil corridors are not compromised for short-term gains.

4. Create a Wildlife Technology Taskforce

Bring scientists, Traditional Owners, community conservationists, and tech experts together to implement the data and design local protections—fencing corridors, modifying land use, and redirecting roads in high-risk zones.

5. Tie All Environmental Impact Assessments to Transparent Data

No major project should proceed without live integration into the biodiversity digital twin, and real-time disclosure of risk to species.

.png)

Comments